Trends in management terms – investor fees

What are the various fees that private equity investors typically charge, how common are they, how do these vary across different investor structures and what are the financial implications?

Introduction – Investor Fees

Investor costs and the other costs of a buy-out (including due diligence fees, corporate finance, tax and legal advisory fees) can be substantial and are borne by all the new shareholders, including the management team who hold an equity interest. Below we discuss the following investor costs in a buyout scenario:

- Arrangement fees

- Ongoing annual fees

- Other fees

Key Findings – Investor Arrangement Fees

Investor arrangement fees are payable by Newco at the time of the transaction and are expressed as a percentage of the investors equity investment they make. As with all costs charged to Newco these require additional funding increasing the effective hurdle before equity value comes into the money.

Over the last three years, across over 40+ different investors, the minimum arrangement fee we have seen charged was nil with the maximum an eye watering 6% of their investment. The largest absolute arrangement fee charged was £5.1million, representing 2% of the equity investment on a £350m+ deal size. The average arrangement fee charged was £1.8million or 2.3% of the equity invested. But not all investors charge arrangement fees.

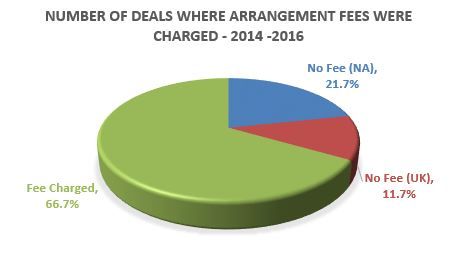

North American investors usually do not charge arrangement fees and even a small number of UK Investors have not charged them but it is more typical for arrangement fees to be charged by UK investors regardless of deal size, with fund structure often determining whether they are charged or not.

Key Findings – Ongoing Annual Fees

Annual recurring investor costs are typically referred to as monitoring fees or investor director fees. They mainly increase by RPI each year and where they are for investor director costs they are per investor director and in most deals there are no more than 2 investor directors.

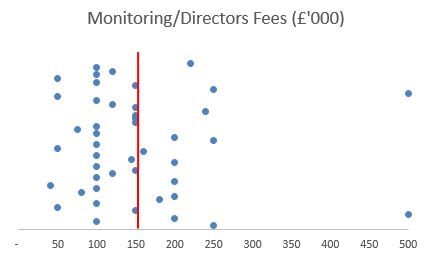

Not all investors however charge an annual fee, with a small number (17%) choosing not to charge any nonitoring/directors fees other than expenses reimbursement. Of the remaining 83% that do charge them, the average fee was £151k with the minimum £40k pa and the maximum £500k pa.

Neither the size of the deal nor the size of the equity investment necessarily determine theses ongoing costs with bidding investors providing a significantly wide range of annual fees for the same transaction. That said, the largest monitoring fees do tend to be associated with the largest transactions.

Key Findings – Other Fees

Exit Fees – Exit fees are rare with a very small number of private equity investors seeking to charge them. This preferred return on exit is typically based upon a percentage of the eventual exit enterprise value of between 1% and 2%.

Summary

It is important to not consider any of these costs on a stand-alone basis but to look at them in the context of the overall economic proposal provided by bidders – what is clearly crucial is to establish them in the first place.