Trends in management terms – ratchets

How common are Ratchets, on which deals are they most commonly proposed and how are they are structured?

This article considers Sweet Equity Ratchets that have been proposed by bidding Private Equity Investors to “top up” a Base Sweet Equity offer to provide an additional Incentive. They increase the Sweet Equity available above certain Hurdles but the increased Sweet Equity percentage typically only applies to that slice of value above the Hurdle.

These are not to be confused with US style Incentive Schemes where typically all the Sweet Equity Incentive is based upon achieving multiple of money (MoM) hurdles.

Key Findings – Ratchets

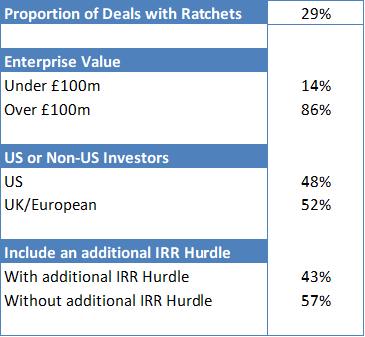

Across all proposals from bidders over the last 3 years, there is very significant variance in the use of ratchets depending on deal size. For transactions below £100m only 10% provided an additional Incentive through a Ratchet mechanism whilst this increased to 90% for those transactions above £100m.

Of those proposals with Ratchets the clear majority (86%) were in deals where the Enterprise Value is over £100m; however, there was near 50:50 split between US Investors and UK/European Investors proposing them.

Ratchets are still very much “a House view” with most mid-market Private Equity Investors preferring to provide a higher Base Sweet Equity position rather than using a Ratcheted structure to incentivise management.

All Ratchets included a multiple of money Hurdle which must be met and 43% also included an additional time related Hurdle, an IRR Hurdle.

The lowest MoM Hurdle was 2x with highest at 3.5x, with the largest proportion of Ratchets kicking in at 2.5x MoM, essentially reflecting Investors target returns.

The additional Sweet Equity available on this “top slice”, i.e. only in that equity above the Hurdle, was typically either 5% or 10% with the lowest 3% and the highest an additional 20%.

Conclusion

Clearly Ratchets need to be considered and modelled in the context of the Base Sweet Equity proposed together with Management’s own view as to how the business can grow over the cycle of the Investors ownership of the business. A full returns analysis is therefore vital for management to understand the risk adjusted returns available from the equity proposals presented to them.