Why would management re-invest?

The fundamental rationale for private equity investment is that the private equity sponsor is backing management and where that management team has proceeds from a transaction, the investor needs to be confident that management are investors and buyers alongside them

Where an investor does not have this confidence the investment decision becomes binary i.e. the investor will not buy the business. However, management’s investment should not be seen as a price reduction opportunity and management should only re-invest if they are happy that the following fundamental principles of fairness are being applied to their re-investment:

- The re-investment is pari-passu with that of the investors

- The re-investment is protected should the manager leave the business

- The re-investment has liquidity, i.e. there is a likely exit event in the foreseeable future

Below we discuss the level of management re-investment we see and trends over the last 10 years as well recent changes in investors approach to the core principles above.

Key Findings – Management Re-Investment

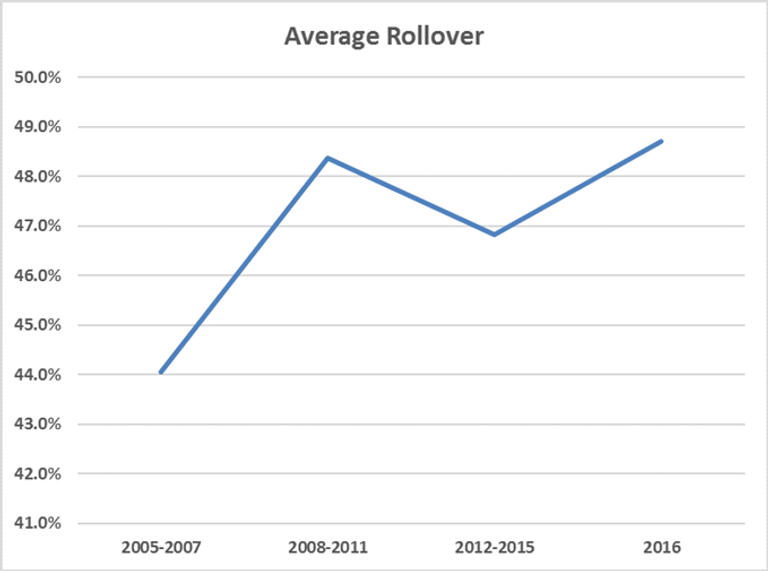

UK mid-market target re-investment has very much been 50% of all management proceeds with special dispensation for specific matters required to vary this.

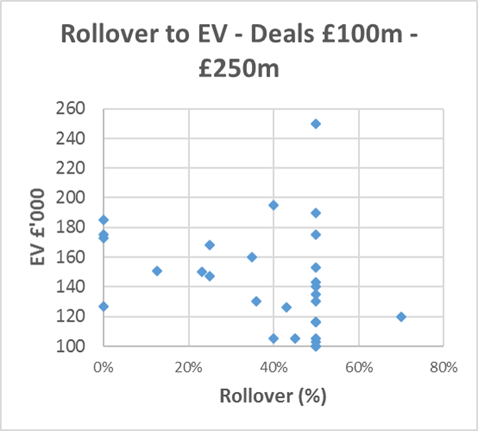

It is important to ensure that the re-invested proceeds to which the percentage apply are those after sell side costs and the managers expected tax liability on those proceeds. The proportion of proceeds that re-investing management teams are being asked to re-invest by a new private equity owner has averaged 46.6% across all deals over the last 10 years.

Deal size does not impact the level of re-investment required with the following being the main determinants resulting in outliers:

- US investors who typically are more focussed on the absolute quantum that management are re-investing rather than the proportion of their proceeds

- The level of competition for the business, with uncompetitive processes resulting in higher than average re-investment and very competitive processes enabling lower than average re-investment to be achieved

- Specific circumstances relating to individuals within the management team, including management actively re-investing more than 50%

- Negotiation to keep certain manager proceeds outside of the re-investment, for example, prior sale proceeds

Trend In the Proportion Rollover

There has been an upwards trend in the proportion of rollover required from management from an average of 44% pre 2008 to just under 49% in the last 12 months.

Other recent trends that relate to management re-investment include the erosion of the principle that re-invested proceeds sit outside leaver provisions with an increasing number of investors successfully arguing that if a manager leaves (usually but not always under limited and specific circumstances such as joining a competing business) that manager’s re-invested proceeds are impacted.

The impact can vary but can include some or all of the following; the institutional equity valued at the lower of cost or fair market value at the point of leaving (despite there being no liquidity requirement), reduced loan note interest rates and / or reduced loan note values.

Other recent trends that relate to management re-investment include the erosion of the principle that re-invested proceeds sit outside leaver provisions with an increasing number of investors successfully arguing that if a manager leaves (usually but not always under limited and specific circumstances such as joining a competing business) that manager’s re-invested proceeds are impacted.

The impact can vary but can include some or all of the following; the institutional equity valued at the lower of cost or fair market value at the point of leaving (despite there being no liquidity requirement), reduced loan note interest rates and / or reduced loan note values.